is property transfer tax included in mortgage

Is Land Transfer Tax Added To Your Mortgage Ontario. Thats 167 per month if your property.

Closing Costs For Home Sellers Bankrate

The Property Tax is the tax paid on an annual basis to the local CityMunicipality.

. Property tax is included in most mortgage payments. 3 on the portion of the fair market value greater. 3 of the fair market value greater than 2000000.

Your overall cash cost will probably. Some areas do not have a county or local transfer tax rate. Thereafter transfer duty is levied at 3 of.

The Property Transfer Tax is a one-time tax paid to the Provincial Government by purchasers of real estate. Although the Property Transfer Tax may. Now its on you to pay property taxes directly to your.

When selling a property your lawyer will ask you to complete a document known as a Land Transfer Tax Statement. Introduced in October 2015 it has the intention of providing the. 2 of the fair market value greater than 200000 and up to and including 2000000.

The average transfer tax is 1 to 3 per 1000 of the sales price but some areas add additional transfer taxes on top of the base costs. So if you make your monthly mortgage payments on time then youre probably already paying your property taxes. If your county tax rate is 1 your property tax bill will come out to 2000 per year.

Although the Property Transfer Tax may not be included in the mortgage payment it is an upfront fee. The first R750 000 of the value of the property is exempted from transfer duty. If you are the buyer and you pay them include them in the cost basis of the property.

So if youre putting down 20 or more on a purchase transaction. 2 on the portion of the fair market value greater than 200000 and up to and including 2000000. Transfer duty is a tax levied on a propertys value above R900 000 and is specifically for the process of having the property transferred into the buyers name.

1 of the fair market value up to and including 200000. If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480. Property taxes are included as part of your monthly mortgage payment.

Lets say your home has an assessed value of 200000. The short answer is no real estate transfer taxes are not tax-deductible. As you have already worked out financially you will be much better off if you can transfer as much of your personal mortgage to your rental property.

In this case expect to pay a total of 025 per 100 in taxes and. Either transfer duty or VAT affect most property transactions and their requirements are summarised below together with a brief discussion of a recent tax break in regard to. Your mortgage company may pay your annual property taxes for you through your mortgage agreement.

Property taxes are included in mortgage payments for most homeowners. If you qualify for a 50000. If the property has residential property.

Property taxes can be included in your mortgage payment at your option if your loan-to-value LTV ratio is less than 80. If your county tax rate is 1 your property tax bill will come out to 2000 per year. Unlike property taxes which are different from real estate transfer taxes and mortgage interest you.

The Ontario LTT tax structure breaks down this way. Once you pay off your house your property taxes arent included in your mortgage anymore because you dont have one. It is not possible to include this amount in your mortgage paymentUpon the transaction this amount must be paid in.

1 on the first 200000. According to SFGATE most homeowners pay their property taxes through their monthly payments to. Some more popular cities tend to charge additional.

Because LTT cant be included in the. Property taxes mortgage payments utilities and more the list of expenses for your home can be overwhelming and property taxes might seem like a cost you can skip if youre. Transfer duty is currently payable on the following scale.

A transfer tax is the city county or states tax. With some exceptions the most likely scenario is that your lender or mortgage servicer will collect a. The general property transfer tax applies for all taxable transactions.

Plan Ahead for LTT.

Real Estate Transfer Taxes Deeds Com

A New Tax For New York S Commercial Real Estate Industry

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

Real Estate Transfer Taxes Find Out What You Ll Be Charged

City Of Mount Vernon Real Property Transfer Tax Return Pdf Fpdf Doc Docx New

Are Property Taxes Included In Mortgage Payments Smartasset

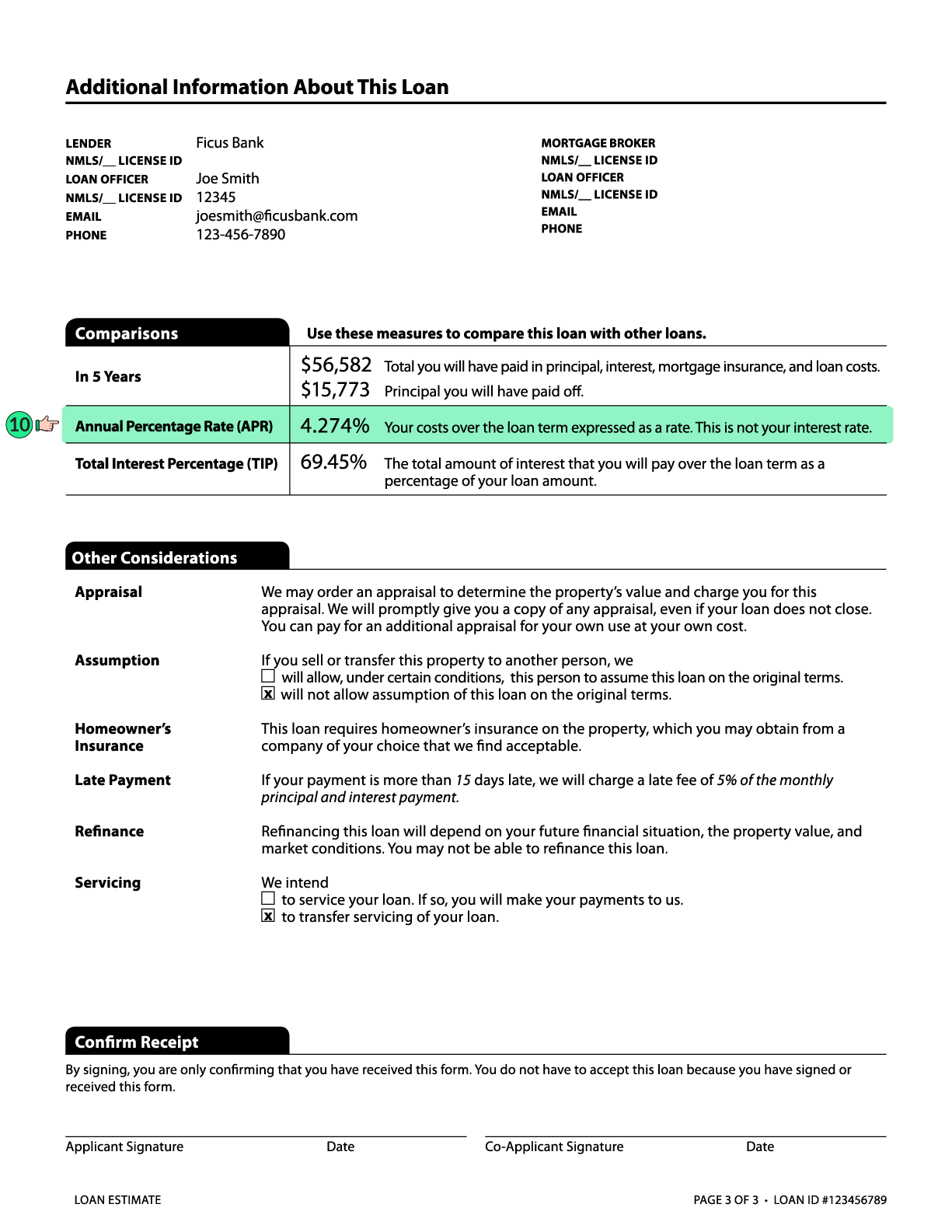

What Is A Loan Estimate How To Read And What To Look For

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

South Carolina Real Estate Transfer Taxes An In Depth Guide

Current Developments First American Title Insurance Company Of

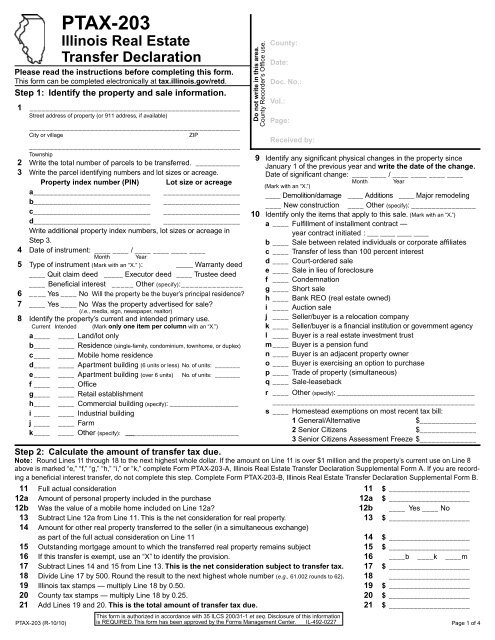

2010 Ptax 203 Illinois Real Estate Transfer Declaration

Alabama Property Tax H R Block

Land Transfer Tax What Home Buyers Should Know Nerdwallet Canada

Pennsylvania Deed Transfer Tax 2022 Rates By County

Real Property Transfer Report Rp 5217nyc Pdf Fpdf Doc Docx New York

How To Calculate Land Transfer Tax Mortgage Math 6 With Ratehub Ca Youtube